2021-48 you are applyingeither section 3011 2 or 3. Accordingly the section provides that.

Fillable Form 1040 2019 Income Tax Tax Return Income Tax Return

Simplified outline of the relationship between this Division Division 6E and Subdivisions 115-C and 207-B of the Income Tax Assessment Act 1997 95AAB.

. Income from businesses where foreign exchange loss or gain is realized. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Income charged under section 583.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Exceptions to charge under section 583. INCOMES WHICH DO NOT FORM PART OF TOTAL INCOME.

Once the Trust organisation or NGO is established they have to register as per Section 12A of the Income Tax Act for claiming exemption under Section 11 and 12 of the Income Tax Act. Section 5431i and j. 4A of section 80-IA.

Section 12A enables non-profit entities such as Charitable Trusts Non-Profit Organisations Welfare Societies Religious Institutions etc to claim full tax. It is deadline before which any investments under Section 80C of the Income Tax Act 1961 must be made. Income charged under section 587.

Short title and commencement. APPLICATION TO OFF-SHORE AREA. If you have tax-exempt income resulting from the forgiveness of a PPP Loan attach a statement to your return reporting each taxable year for which you are applying Rev.

5 Section 1394a Income Tax Return of Charitable and Religious Trusts. PART II IMPOSITION OF INCOME TAX 3. Payment to body outside the UK.

Tax returns must be verified by this time. Beginning June 1 2007 an additional sales use and casual excise tax equal to one percent is imposed on amounts taxable pursuant to this chapter except that this additional one percent tax does not apply to amounts taxed pursuant to Section 12-36-920A the tax on. Charge to tax on income from disposals of know-how.

2021-48 and which section of Rev. 1 Previous Next. Income Tax Act 1959 No.

Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997--references in this Act to assessable income under section 97 98A or 100 95AAC. Export processing zone. For any intentional mistakes or omissions and for any fraudulent filing penalty will be imposed on the tax payer.

The Form ITR 7 for person including companies which are required to furnish return under Section 1394A or 1394B or 1394C or 1394D or 1394E or 1394F of the Income Tax Act. Income Tax 3 Issue 1 CHAPTER 470 INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 Under Proposed Regulations 113295-18 an excess deduction on termination of an estate or trust allowed in arriving at adjusted gross income Internal Revenue Code IRC section 67e expenses is reported as an adjustment to income on Forms 1040 1040-SR and 1040-NR.

Statements or certificates deliver de-claration allow inspection etc under sections 133 134 1394A 1394C 1922C 197A 203 206 206C 206C1A. Person liable for tax under section. Due date to file income tax return.

4A or 1394B or 1394C or 1394D or 1394E or 1394F ITR-V. I Amount of fee payable for late filing of return of income Section 234F1. Section 4 of the Income-Tax Act 1961 is the Charging section of the Act.

As per Section 231 Person for the purpose of Income Tax Act includes inter alia a Local Authority. Section 1395 is specifically applicable to cases of Omissions and Wrong Statements and not meant for Concealment or False Statements. Income tax for the previous year is to be charged according to the given rates.

There are changes that may be brought into force at a future date. This form is for persons including companies under section 1394A 1394B. Income Tax Act 2007 is up to date with all changes known to be in force on or before 31 August 2022.

Income Tax E-filing Due Date. Without prejudice to the provisions of this Act where a person required to furnish a return of income under section 139 fails to do so within the time prescribed in section 1391 he. It will draw penalty as per the regulations mentioned in section 77.

Income Tax Act 1959. Sales of patent rights. Section - 10 Income-tax Act 1961-2019 No.

Person liable for tax under section 583. To Email Your Name Your Email Message. Charge to tax on income from sales of patent rights.

Section 2792 of Income-tax Act empowers a Chief Commissioner of Director General of Income-tax to compound an offence either before or after the institution of prosecution proceeding. Additional sales use and casual excise tax imposed on certain items. Under Rule 4A of the Service Tax Rules 1994 it is compulsory for a service tax assessee to issue a bill or invoice within 14 days from the date on which the taxable service was completed or the date on which the payment was received for the service whichever comes first.

For the purpose of section 1020 which provides for exemption of income of Local Authority subject to certain conditions the expression Local Authority means i Panchayat as referred to in clause d of Article 243 of the Constitution. Shall be deemed to be salary or wages income taxable at the rate declared by Section 12 of the Income Tax Salary or Wages Tax Rates Act 1979. Tax year in which certain expenditure treated as incurred.

23FA any income by way of dividends other than dividends referred to in section 115-O. Between October and November. The rates are prescribed under the finance act of every assessment year.

Refund Of Tax Under Income Tax Act 1961 Under Section 237 To 245 Tax Refund Concept Meaning Commerce Notes

Income Tax Act In Canada Kijiji

Section 139 1 Of Income Tax Act Importance Of 139 1 Income Tax Act

Pin By The Taxtalk On Income Tax In 2021 Taxact Income Tax Income

Types Of Income Exempted From Income Tax In India Income Tax Income Income Tax Return

Income Tax Itr Filing Error And Solution Invalid Xml File Error When Uploading Income Tax Income Solutions

Health Insurance Tax Benefits Health Insurance Plans Health Insurance Health Insurance Benefits

Income Tax Act In Canada Kijiji

All About Section 194a Of The Income Tax Act Tds Limit Tds Deposit Time Limit Youtube

2015 2021 Form Irs 8822 Fill Online Printable Fillable Blank Pdffiller Change Of Address Money Template Irs

Income Exempted Taxact Tax Deductions List Money Financial

Best Investments In 2020 Investing Managing Finances Best Money Saving Tips

Taxation Principles Dividend Interest Rental Royalty And Other So

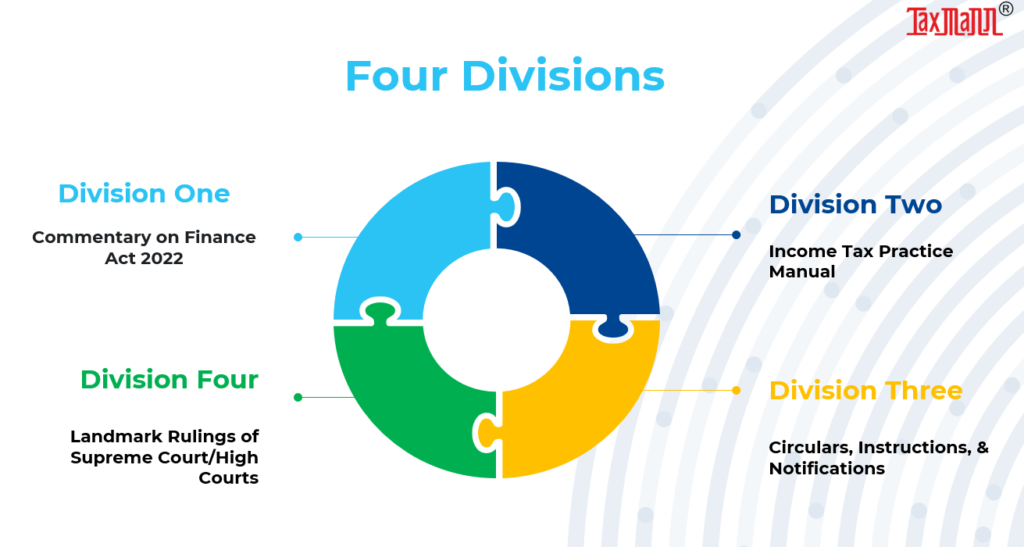

How To Do Income Tax Research Using Master Guide To Income Tax Act

Taxation Principles Dividend Interest Rental Royalty And Other So

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri

How To Do Income Tax Research Using Master Guide To Income Tax Act

Dissolution Reconstitution Of A Partnership Firm Section 45 4 Revised Section 45 4a Introduced Partnership Capital Account Cooperative Society